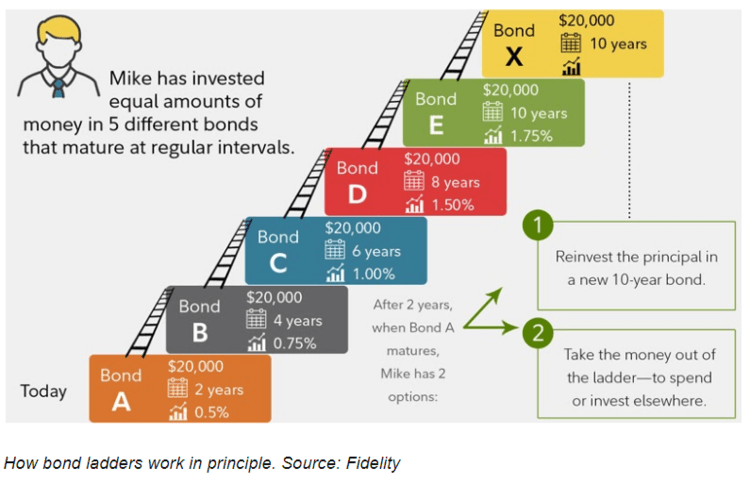

A bond ladder is a portfolio that consists of individual CDs and bonds that mature at different times. This strategy provides current income and minimizes interest rate fluctuations. Instead of buying bonds due to maturity in the same year, buy CDs or bonds which mature at different future dates. Investors can spread out the maturity dates to avoid trying to time markets.

Investors can ride out fluctuations in interest rates by being disciplined and reinvesting proceeds from maturing bonds.

What are the main goals of a bond-loan ladder?

A bond ladder can assist investors in achieving two main goals.

Manage interest rate risk

Investors can avoid being locked into one interest rate by varying maturity dates. The effect of fluctuating interest rates can be smoothed out by a ladder. There are bonds that mature every year, quarter or month depending on how many rungs there are in the ladder. An investor can reinvest the principal of a bond when it matures in a longer-term bond at one end of a ladder. They will benefit from a higher interest rate if interest rates have increased. This will keep the ladder running. If interest rates fell, the maturing bonds would be reinvested at lower rates but the bonds at end of the ladder would have likely locked up higher yields.

Cash flow management

Investors can create predictable monthly income by structuring their bond income using coupon payments that have different maturity months and years, as many bonds pay interest twice per year on dates that coincide with their maturity dates.

How does a bond ladder get created?

It is very easy to build a bond ladder. When building a bond ladder, the main considerations are length, spacing between maturities, and the type of securities. Bond ladders are able to help balance income and manage interest rate risk in any interest rate environment.

Rungs:

With the goal to extend the ladder as far as possible, take the total amount you intend to invest. A $100,000 investment to purchase individual bonds could be used to invest in 10 rungs each of $10,000.

A ladder with at least six rungs can be a great way for investors to create income streams every month.

Spacing:

The time span between the maturities of each bond determines the distance between rungs. This can vary from months to many years. The spacing between rungs should be approximately equal.

While longer maturities offer higher yields, shorter maturities can lead to lower income and interest rate risk.

Materials:

Investors can use different materials to build their ladders, just like a ladder. Investors can also benefit from the tax advantages of municipal bonds and the credit guarantee provided by U.S. Treasuries. They can also take advantage of the higher yields offered by investment-grade corporate bonds.

When building a bond ladder, David Rewcastle recommends investors invest in higher-rated bonds. Low-rated bonds like high-yield bonds have a higher chance of default and can negatively impact your goal of a steady income and a predictable value at the end of your life.

Read: What are fixed-income assets?

What is a bond ladder?

Bond laddering allows you to invest in multiple bonds of different maturities. You can reinvest your principal as each bond or CD matures in new bonds with the same term that you initially chose for your ladder.

You can reinvest at higher interest rates if the rate of interest rises. You’ll still be able to reinvest at higher rates if interest rates drop.

David Rewcastle of Darien, Connecticut, is an Equity and Fixed Income Analyst with a background in Finance and Middle East Studies

Leave A Comment