Chart analysis can give you a deeper comprehension of U.S. crude inventory fluctuations and the factors causing them.

Gain an understanding of the key indicators used to analyze inventory data, their significance, and how to interpret information presented on an inventory chart.

Explore U.S. Crude Oil Inventory Definition

U.S. crude oil inventory: Understanding what this term refers to and the data associated with it is essential for understanding charts and graphs associated with it.

“U.S. crude oil inventory” refers to all crude oil that has been commercially stored in the Inventory Management System (IMS) of the United States government, which monitors storage levels in real-time and reports volume measured in barrels per day (bpd).

When analyzing crude inventories, distinguishing between production, supply, and new demand is key for accurate calculations.

Analyze Trends Over Time with Rolling Averages

Rolling averages are a helpful tool for analyzing trends over time.

One way to understand U.S. crude inventories is by looking at rolling averages over time. A rolling average is simply an average of data points calculated each time a new point is added, and it helps indicate trends in supply and demand as an indicator for inventory levels that may have changed over time.

Combining supply, demand, and production sets gives you a comprehensive view of U.S. crude inventories over time.

Utilize Rig Count in Supply & Demand Analysis

The rig count is an essential indicator when it comes to U.S. crude inventories. When the count increases, this usually signals increased production; conversely, when it decreases, fewer barrels of crude oil are produced.

When assessing current levels of inventories, the rig count can help confirm whether there is either an excess or deficit in supply and demand.

Assess Weekly Inventories Reports’ Influence on Oil Prices

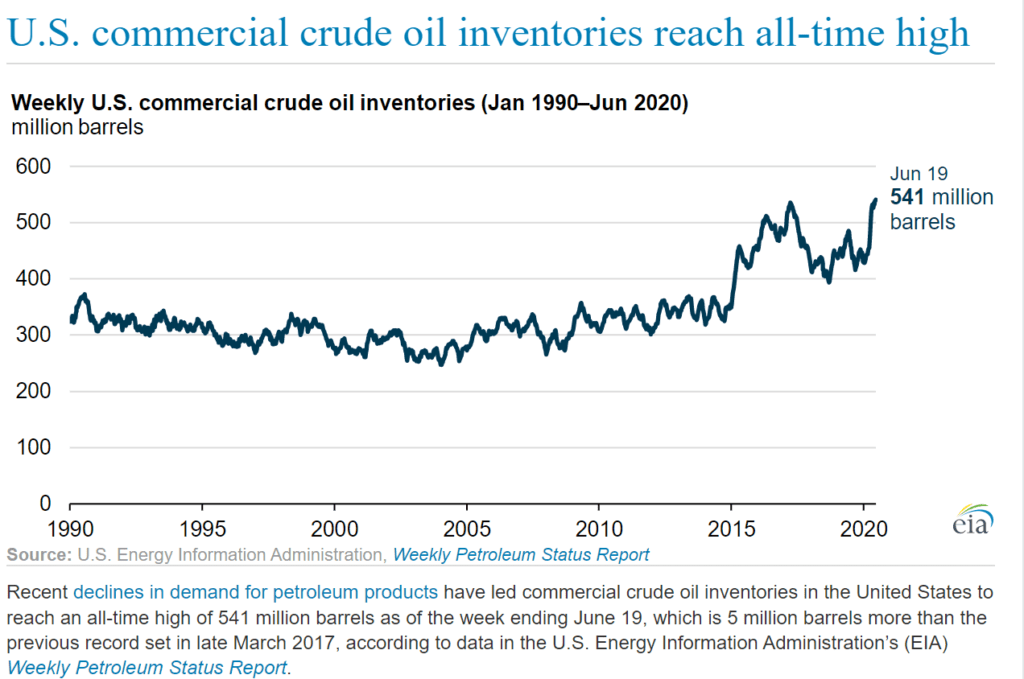

Weekly reports from the Energy Information Administration (EIA) measure U.S. commercial crude inventories and can offer insight into oil price movements.

For instance, if inventories suddenly decline this could lead to higher prices as it indicates strong demand for crude in the US and consequently greater strain on supply levels.

When assessing inventory levels it’s essential to look beyond just one report and focus on long-term trends for an accurate understanding of changes in the oil market.

Recognize Seasonality in U.S. Crude Supply & Demand Patterns

It is essential to recognize how seasonality impacts crude inventories in the US. During summer months, consumers typically use more crude due to power plant cooling needs; consequently, supply levels tend to decline during this period as demand rises.

Conversely, supply levels usually increase during winter months when temperatures drop and Americans use less oil for heating purposes.

Understanding these patterns helps you gauge inventory level changes over time and make informed decisions regarding investments.

David Rewcastle of Darien, Connecticut, is an Equity and Fixed Income Analyst with a background in Finance and Middle East Studies

Leave A Comment